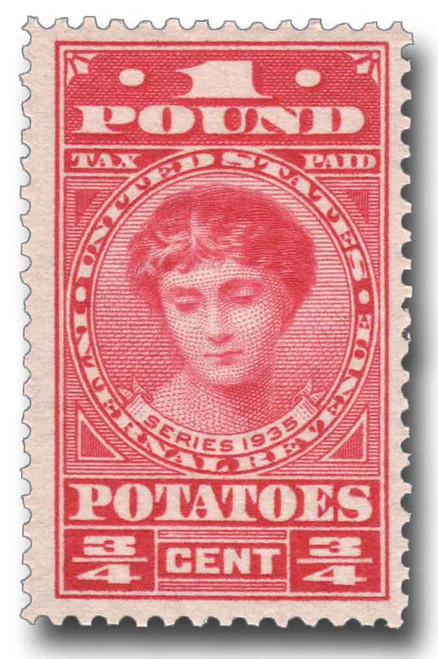

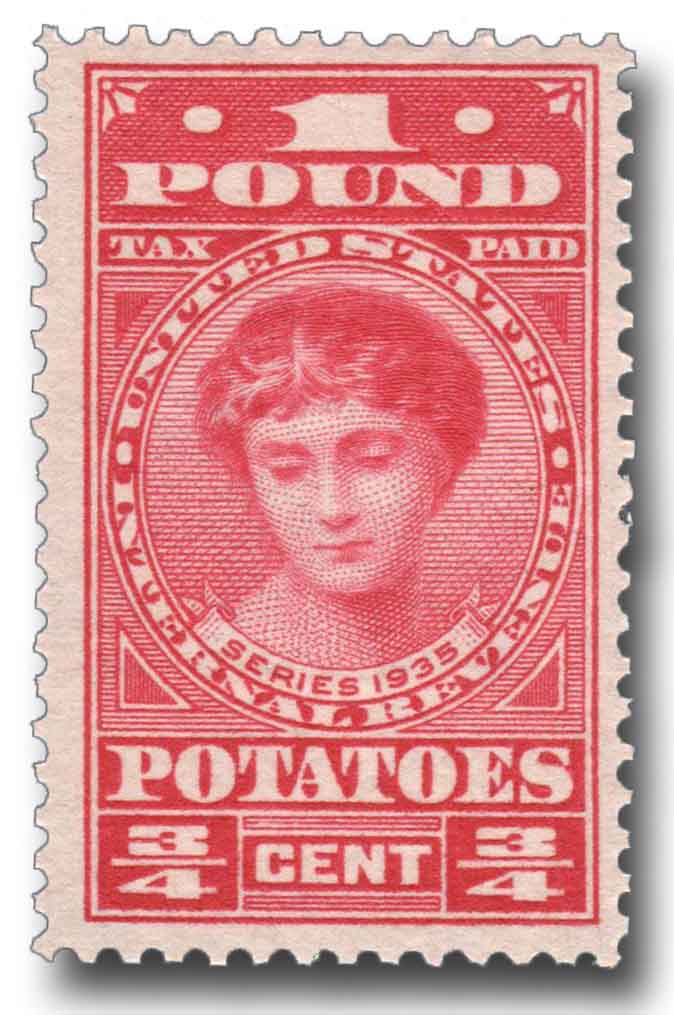

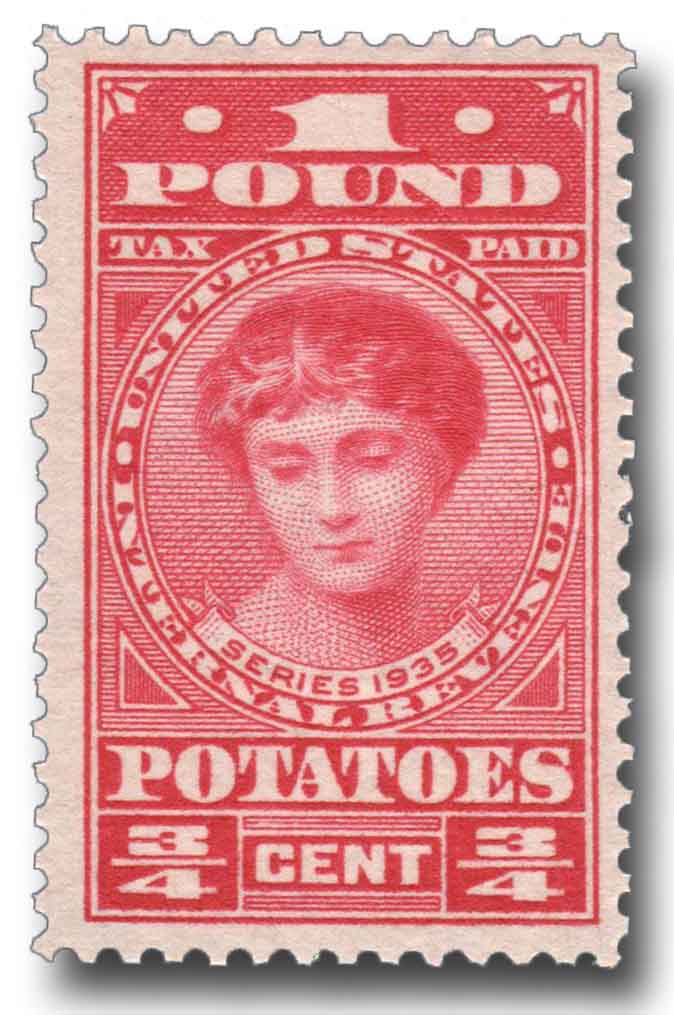

# RI1 - 1935 3/4c Potato Tax Stamp - carmine rose, engraved, unwatermarked, perf 11

Potato Tax Stamps of 1935

Potato Stamps

On August 24, 1935, President Franklin D. Roosevelt signed the Potato Control Law, which led to the creation of short-lived Potato stamps.

The Potato Control Act was an amendment of the Agricultural Adjustment Act (AAA). The AAA had been passed in 1933 by President Roosevelt to help boost agricultural prices by decreasing surpluses. The AAA also created the Agricultural Adjustment Administration to oversee the grants given to farmers.

The Potato Control Act was first brought before the House on June 15, 1935, by John M. Jones and was signed into law two months later. The goal of the law was to help the nation’s 30,000 potato farmers. They were concerned that new farmers who had to abandon their land due to other AAA stipulations might overburden the potato market.

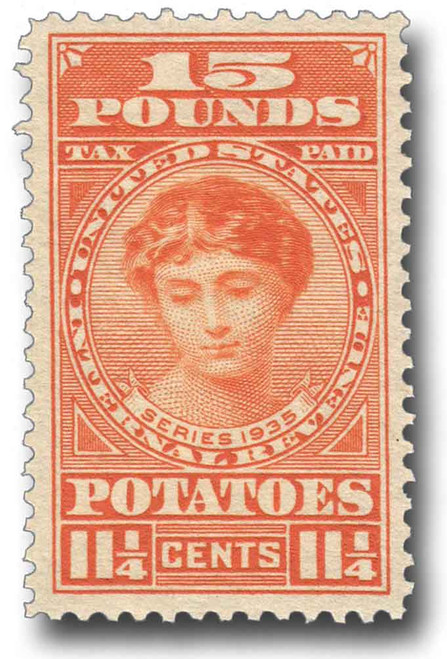

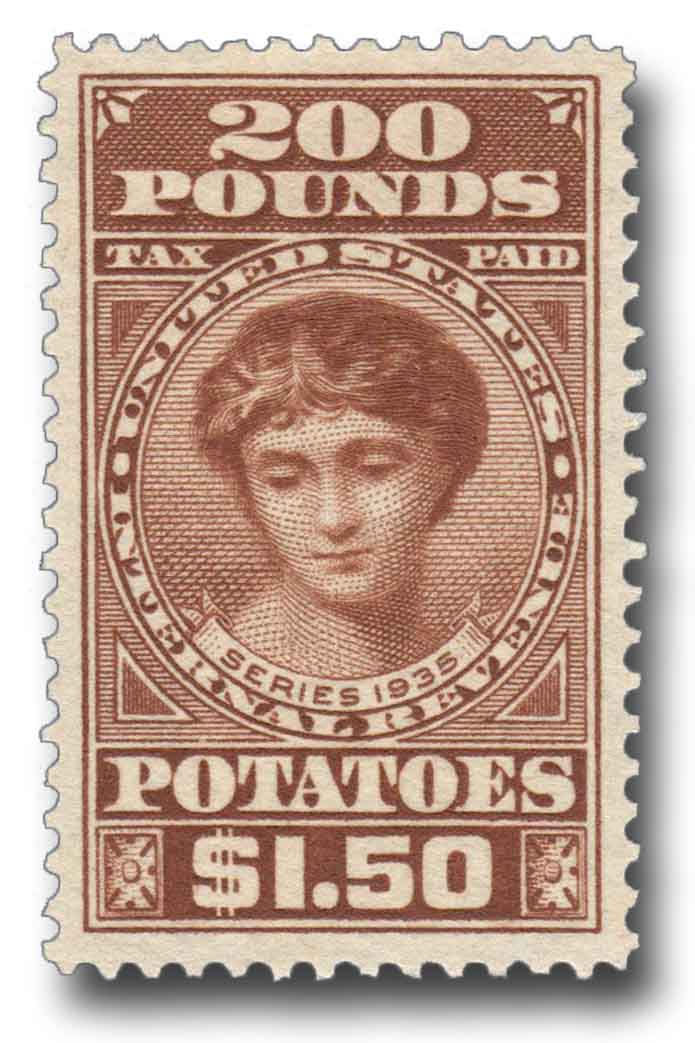

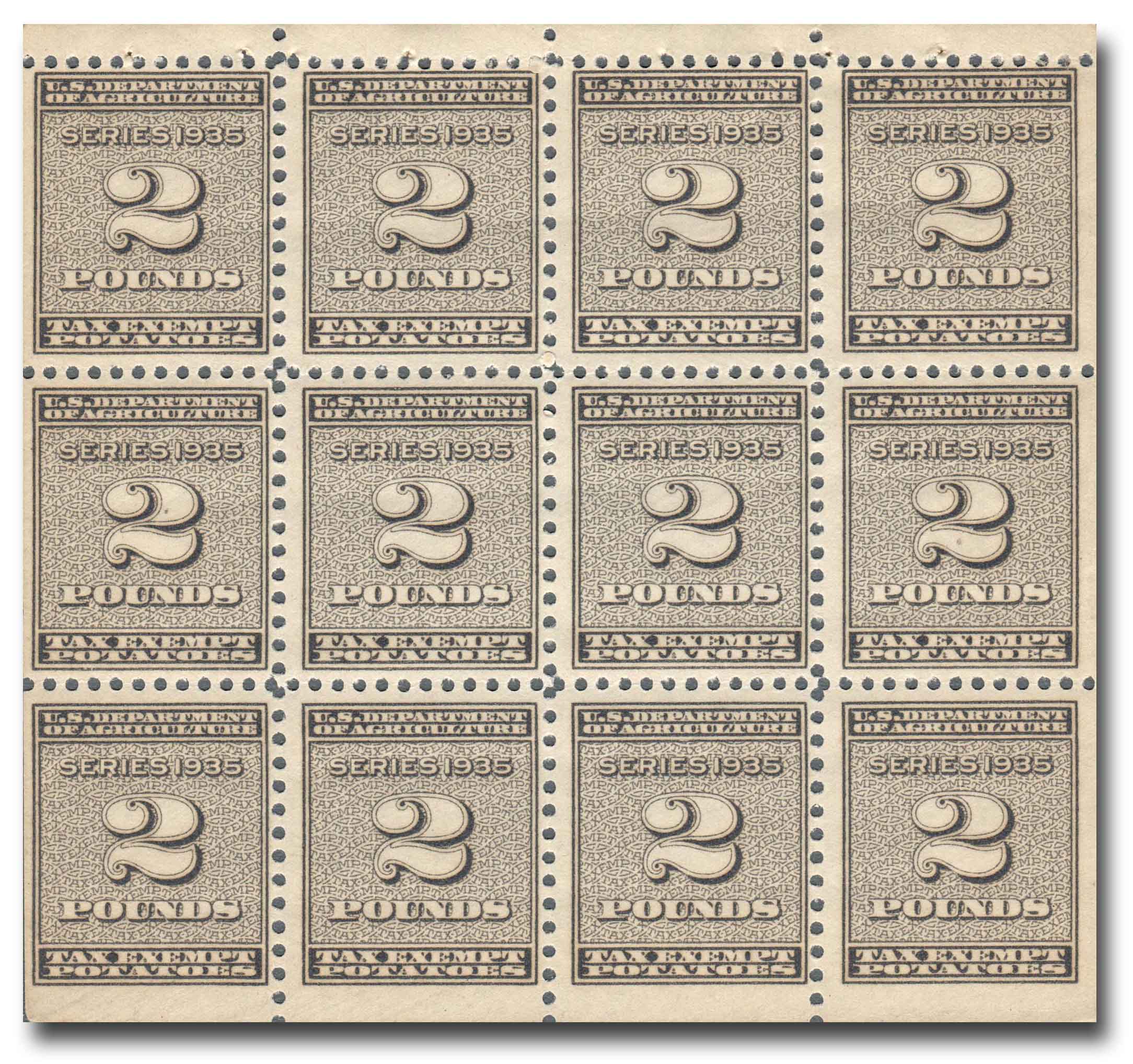

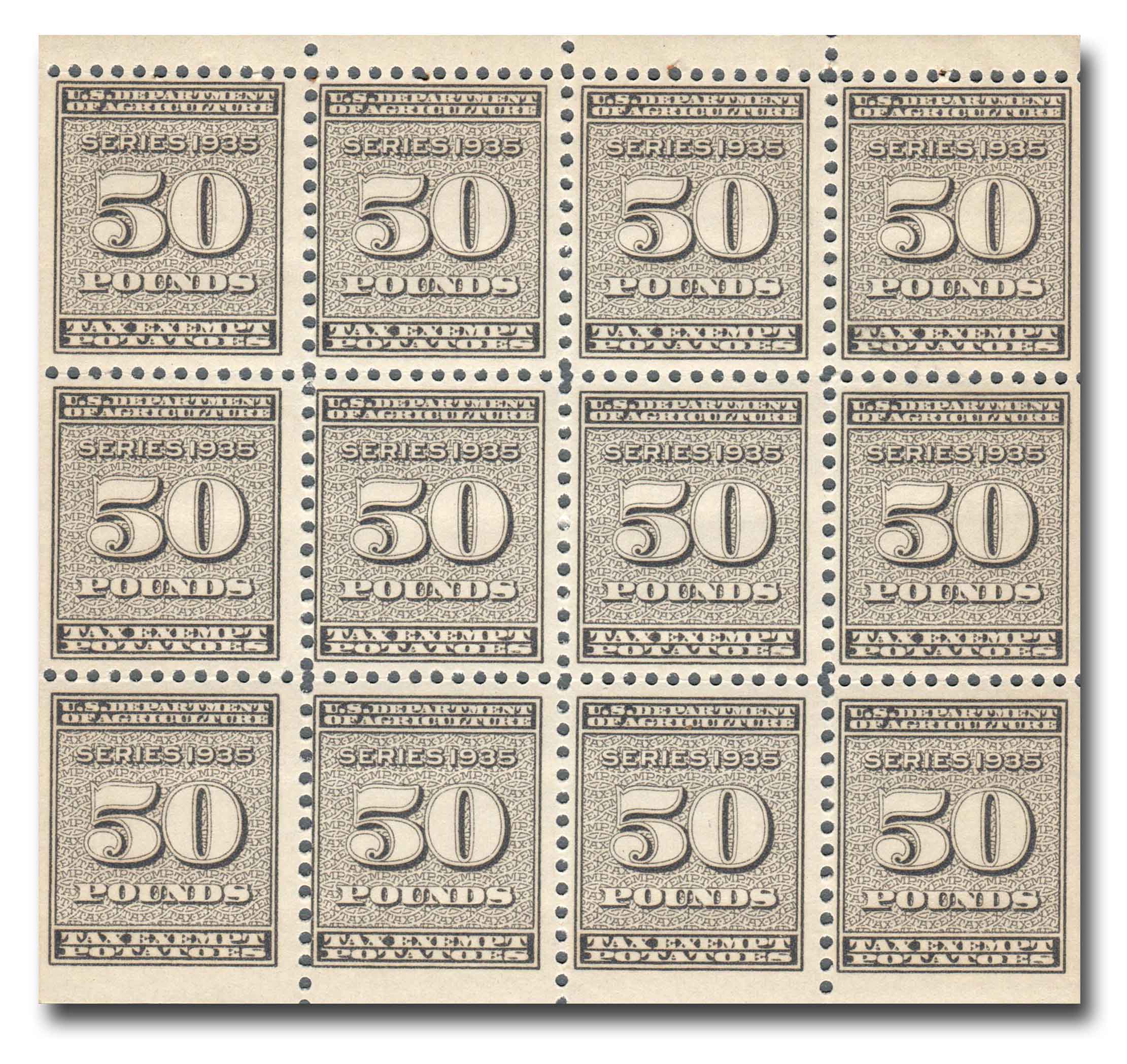

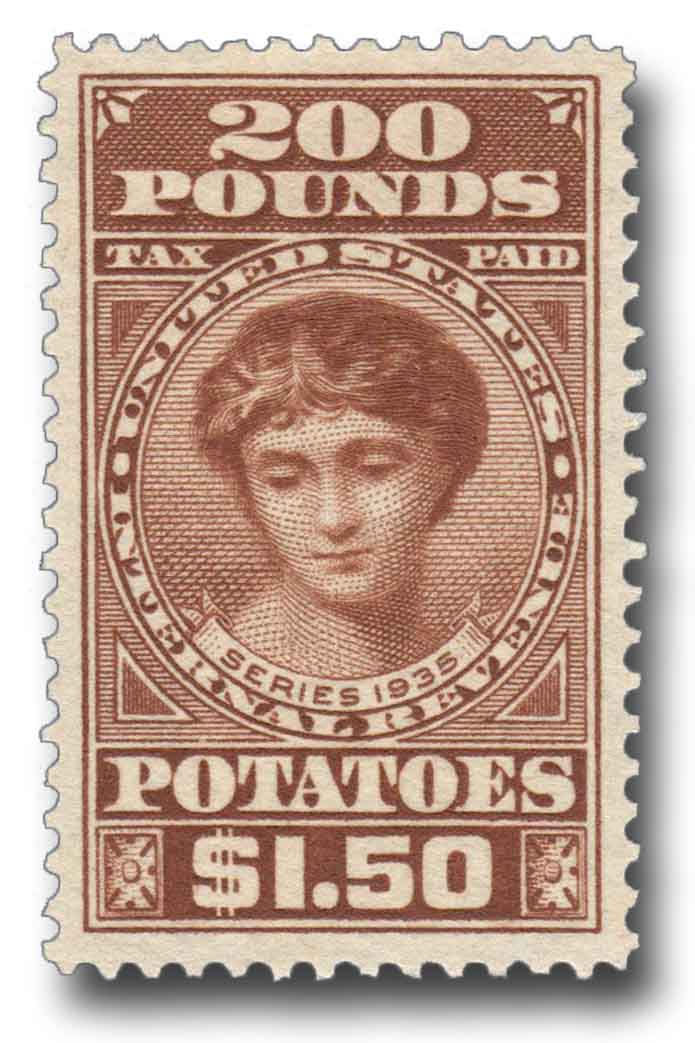

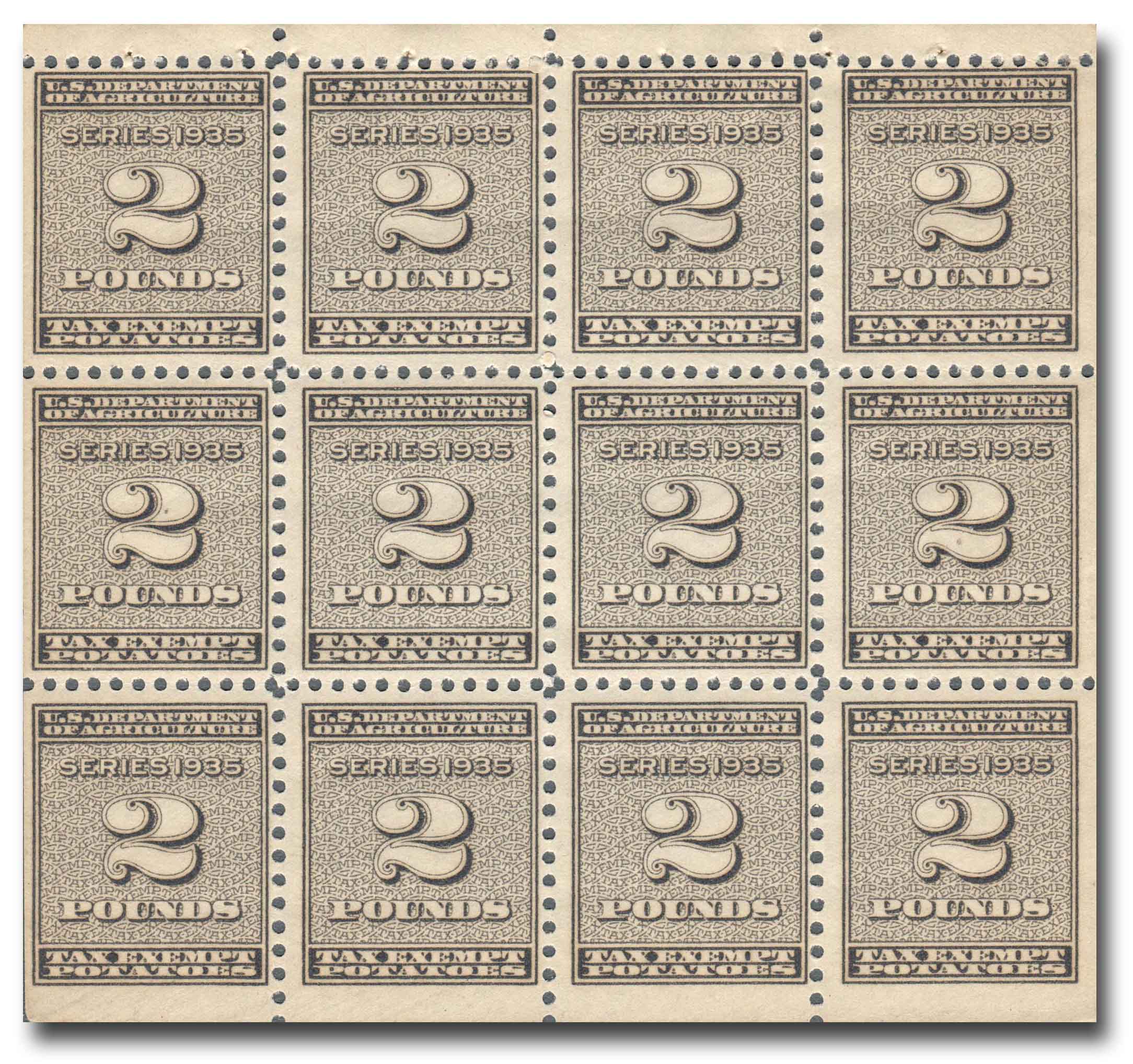

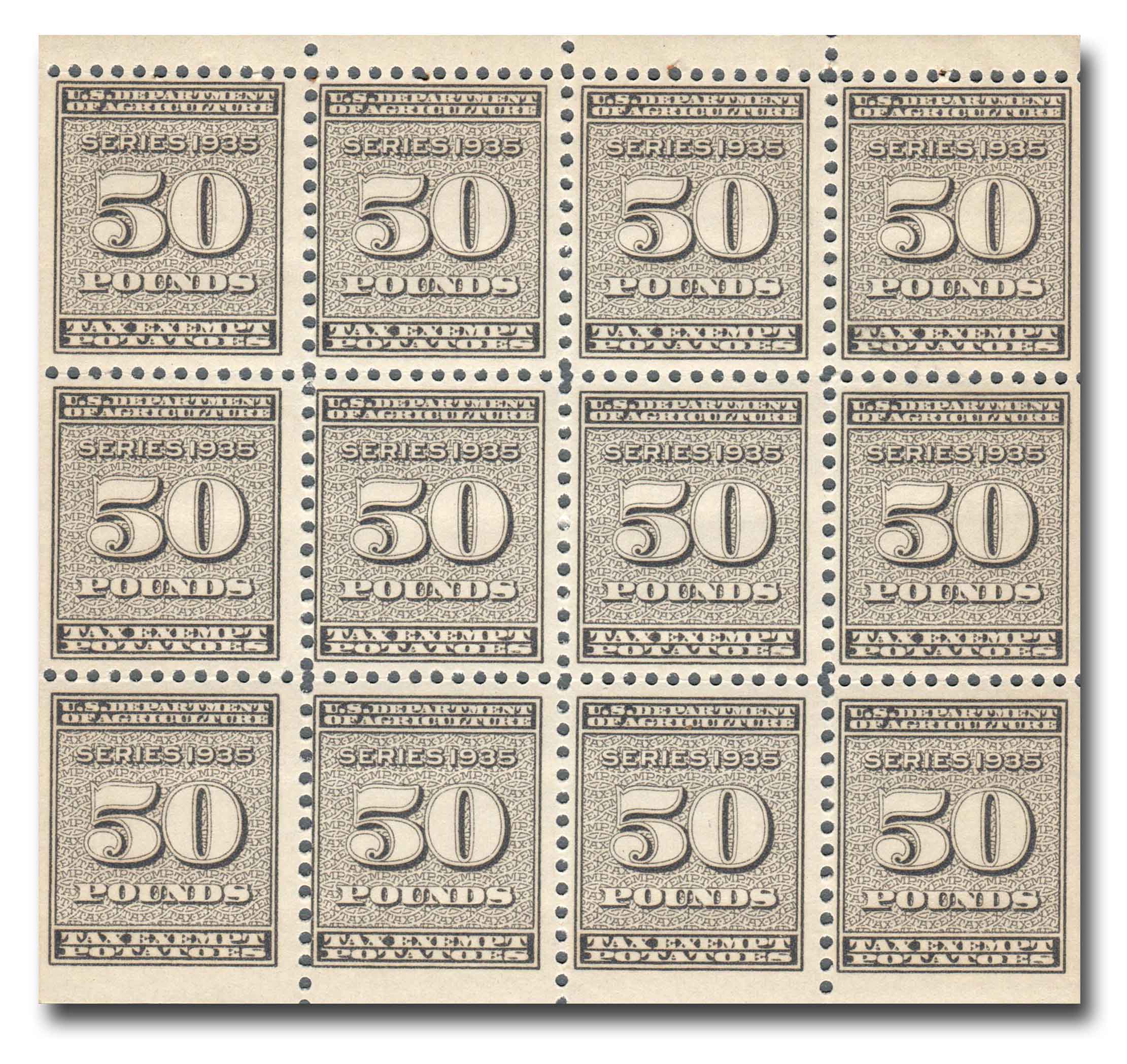

The law went into effect on December 1, 1935. Part of the law restricted potatoes from being exported, instead providing that they be supplied for relief to those in need. The act also included a crop-adjustment program of plowing under every fifth row of potatoes to prevent a surplus. Each farmer was given a quota of production and for any excess had to pay a ¾ cent per pound tax. All the potatoes that were sold under the allotments were tax-free and for this, a tax-exempt stamp was used.

Under this law, people and companies were not allowed to buy or offer to buy any potatoes that were not packed in containers approved by the Secretary of Agriculture and sealed with the official stamps. If anyone was found in violation of the law, they could be fined $1,000 for their first offense and $1,000 and a year in jail for their second offense.

Many saw the act as radical and unconstitutional because the federal government was directly involved in the economic affairs of potato growers. Many were outraged. A group in New Jersey issued a statement, “That we protest against and declare that we will not be bound by the ‘Potato Control Law,’ an unconstitutional measure recently enacted by the United States Congress. We shall produce on our own land such potatoes as we may wish to produce and will dispose of them in such manner as we may deem proper.”

The outrage over the law brought it before the Supreme Court. On January 6, 1936, the US Supreme Court declared that the AAA was unconstitutional. And a month later, the Potato Act was repealed on February 10. Few farmers used the stamps because they were only on sale for less than two months. Potato stamps were the only US stamps valued in an edible commodity.

Potato Tax Stamps of 1935

Potato Stamps

On August 24, 1935, President Franklin D. Roosevelt signed the Potato Control Law, which led to the creation of short-lived Potato stamps.

The Potato Control Act was an amendment of the Agricultural Adjustment Act (AAA). The AAA had been passed in 1933 by President Roosevelt to help boost agricultural prices by decreasing surpluses. The AAA also created the Agricultural Adjustment Administration to oversee the grants given to farmers.

The Potato Control Act was first brought before the House on June 15, 1935, by John M. Jones and was signed into law two months later. The goal of the law was to help the nation’s 30,000 potato farmers. They were concerned that new farmers who had to abandon their land due to other AAA stipulations might overburden the potato market.

The law went into effect on December 1, 1935. Part of the law restricted potatoes from being exported, instead providing that they be supplied for relief to those in need. The act also included a crop-adjustment program of plowing under every fifth row of potatoes to prevent a surplus. Each farmer was given a quota of production and for any excess had to pay a ¾ cent per pound tax. All the potatoes that were sold under the allotments were tax-free and for this, a tax-exempt stamp was used.

Under this law, people and companies were not allowed to buy or offer to buy any potatoes that were not packed in containers approved by the Secretary of Agriculture and sealed with the official stamps. If anyone was found in violation of the law, they could be fined $1,000 for their first offense and $1,000 and a year in jail for their second offense.

Many saw the act as radical and unconstitutional because the federal government was directly involved in the economic affairs of potato growers. Many were outraged. A group in New Jersey issued a statement, “That we protest against and declare that we will not be bound by the ‘Potato Control Law,’ an unconstitutional measure recently enacted by the United States Congress. We shall produce on our own land such potatoes as we may wish to produce and will dispose of them in such manner as we may deem proper.”

The outrage over the law brought it before the Supreme Court. On January 6, 1936, the US Supreme Court declared that the AAA was unconstitutional. And a month later, the Potato Act was repealed on February 10. Few farmers used the stamps because they were only on sale for less than two months. Potato stamps were the only US stamps valued in an edible commodity.