# RE58 - 1916 $50 Cordials, Wines, Etc. Stamp - green

Â

Wine Stamps

On October 22, 1914, the Emergency Revenue Act was passed, which called for the creation of Wine Revenue Stamps.

The US began using revenue stamps on a wide variety of items in the 1860s to help finance the Civil War. Labeled as “sin taxes,†the first alcohol stamps were issued for beer, not wine.Â

The outbreak of World War I in 1914 directly impacted America, significantly decreasing the customs from goods imported from Europe. To make up for this, the government passed the Emergency Revenue Act of October 22, 1914. This act increased the federal excise tax on wine and created a need for new Revenue stamps that were issued later that year.Â

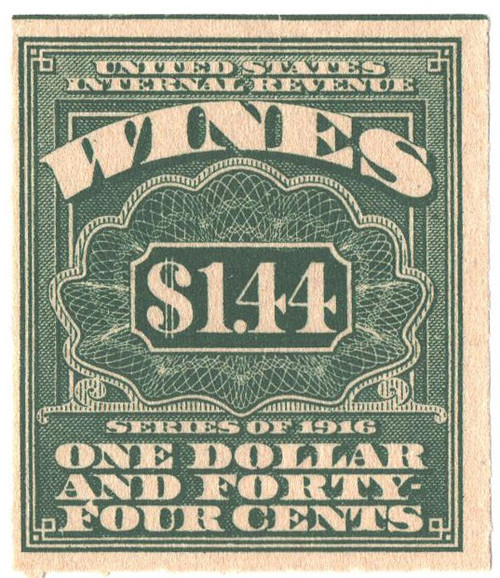

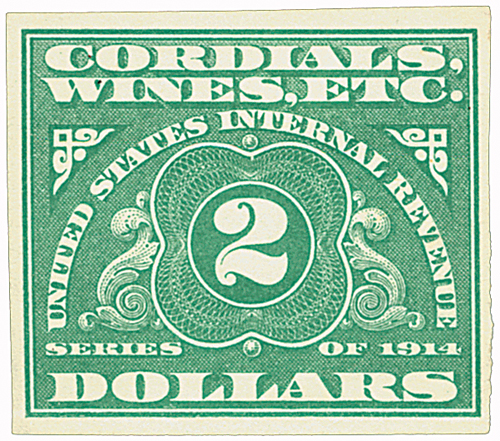

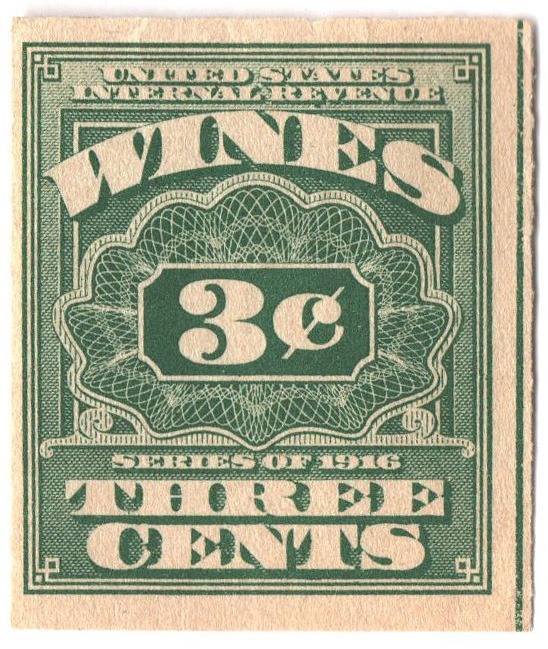

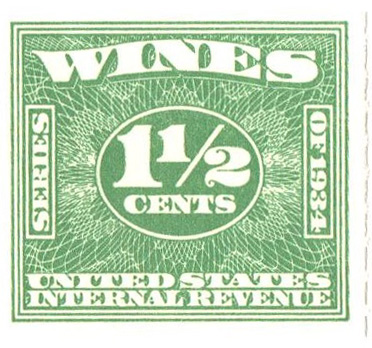

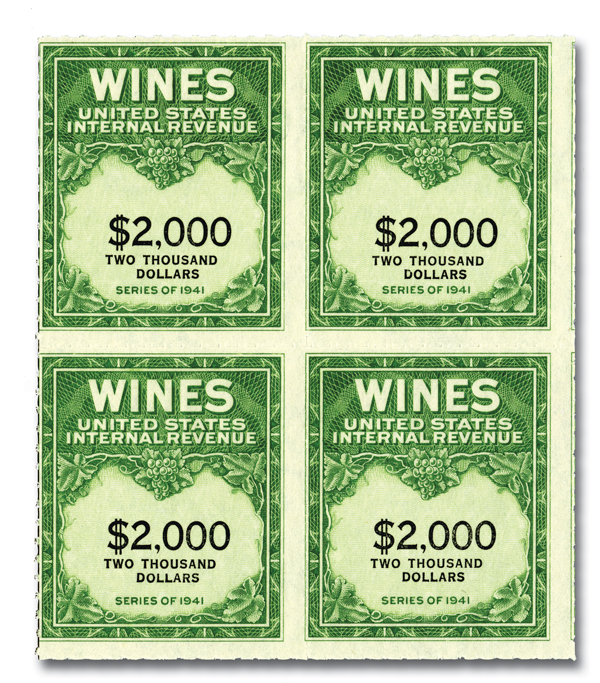

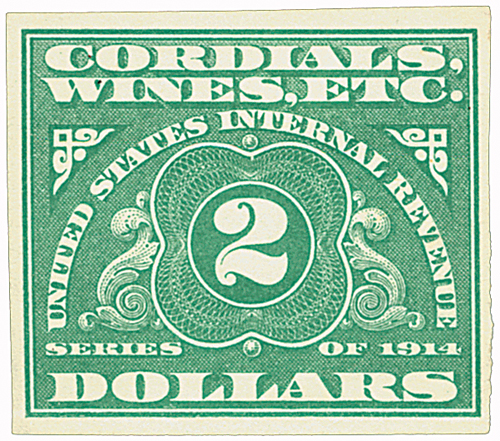

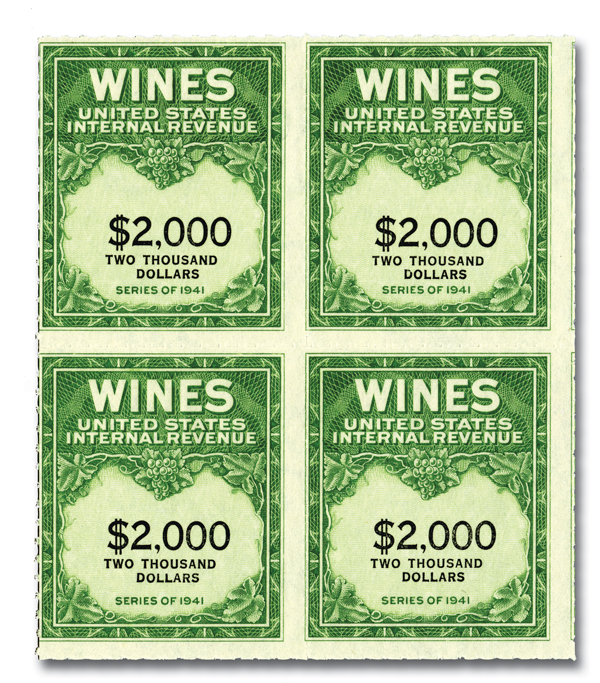

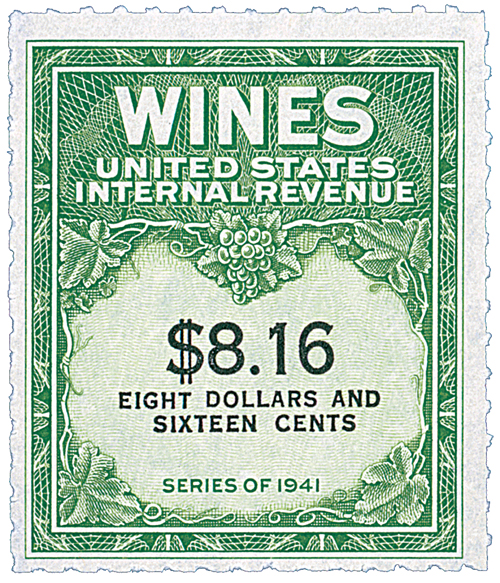

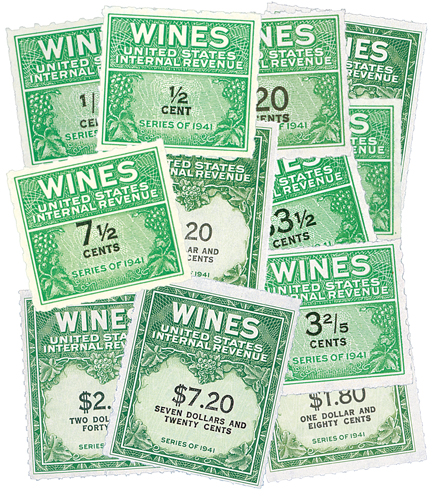

All Wine Revenue stamps were printed on watermarked paper in shades of green. The Series of 1914 stamps included seven major design types with many denominations. Over the course of their use, wine stamps were issued in two sizes. Small stamps fit on single bottles, and had values from 1/5¢ through 96¢. Large stamps had values from $1.00 through $4,000.00. The higher values were used mostly on bulk wines being shipped in tanker trucks or ships. These stamps all feature intricate engraving and later issues pictured grapevines and clusters. Because they were affixed to containers, used Wine Revenue stamps are hard to find. Plus it was illegal to own mint stamps for several years, making them scarcer now.

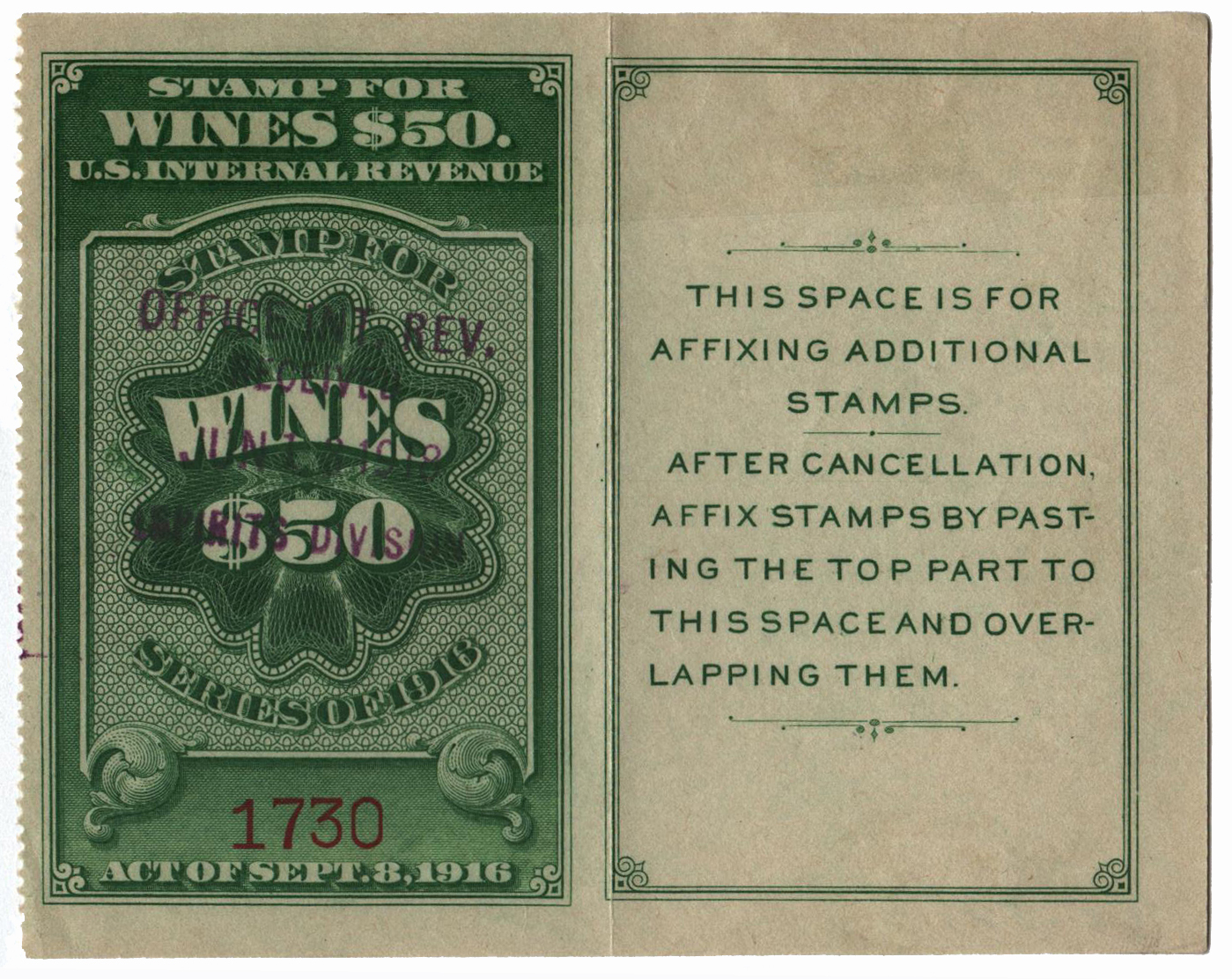

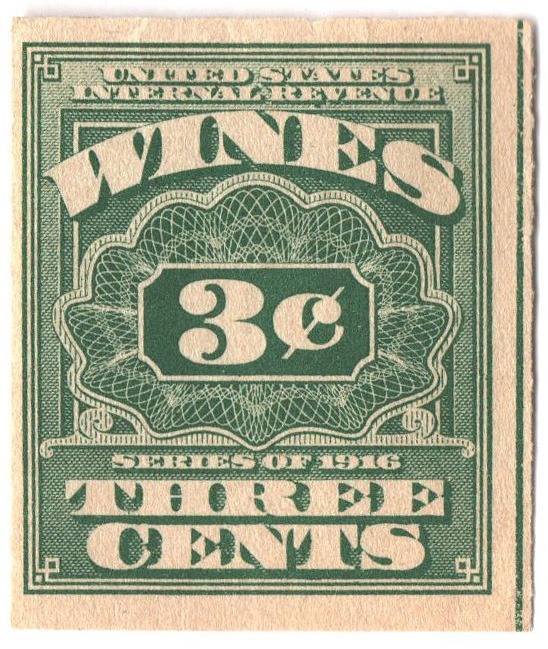

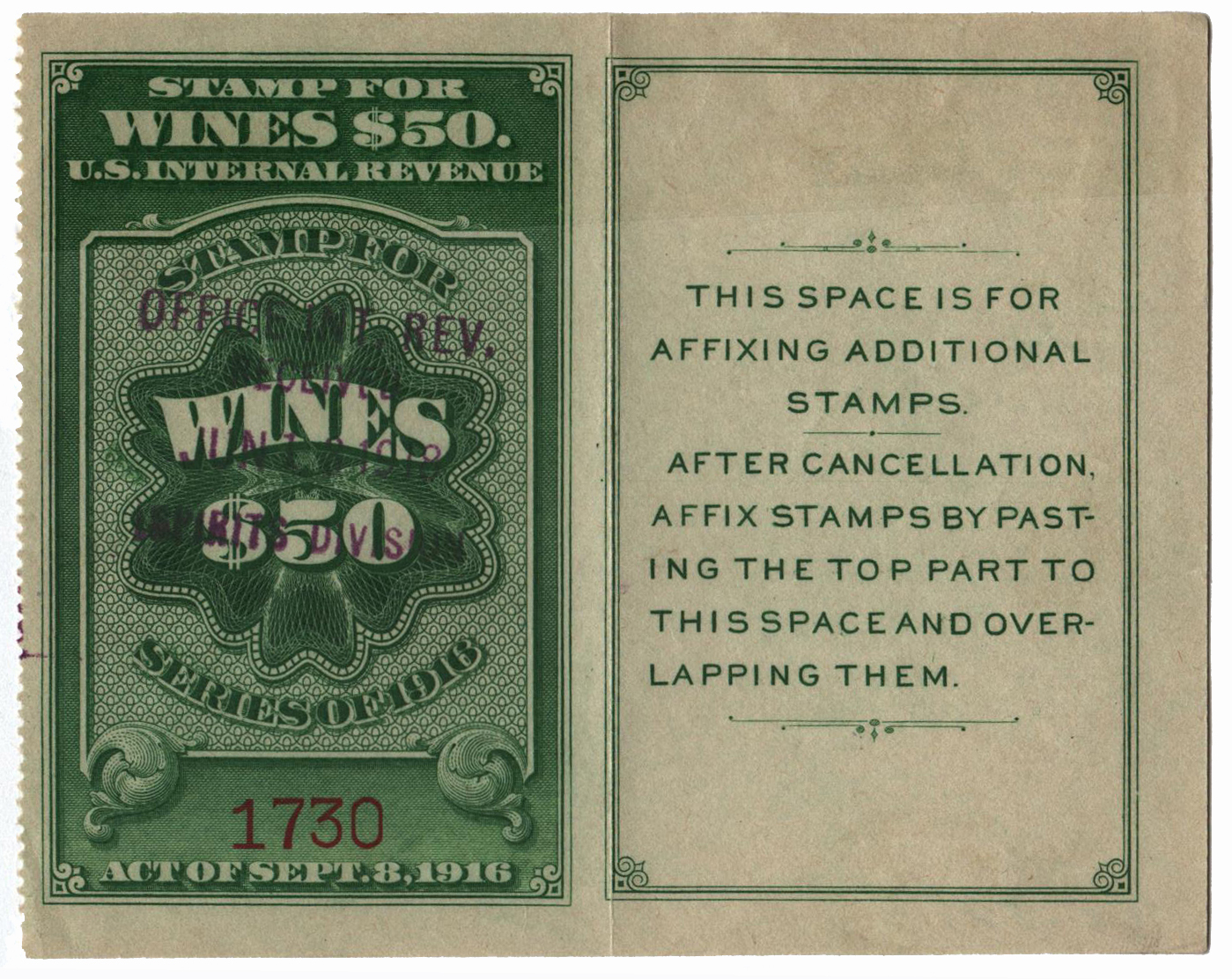

In 1916, a new series of large-format Wine stamps were issued. They were in use from 1916 to 1933 and all featured a “SERIES OF 1916†inscription. All denominations from 1¢ to $2 were offset printed. The $4 through $9.60 stamps were engraved and had small changes made to the outer frame design.Â

The high-denomination Wine stamps ($20 through $100) of the Series of 1916 were issued from 1916 to 1934 and were inscribed “ACT OF SEPT. 8, 1916.â€Â These stamps feature an additional piece of paper to the right (called a tablet) for attaching additional Wine stamps. These new issues were perforated 12 or 12 1â„2 on the left only. The rest of the sides were imperforate.Â

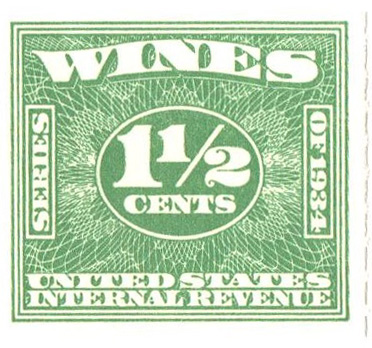

From 1934 to 1940, lower-denomination Wine stamps were issued in smaller sizes once again. In addition to new smaller Wine stamps, there were also new large-format stamps. These were the 40¢ through $5 denominations.Â

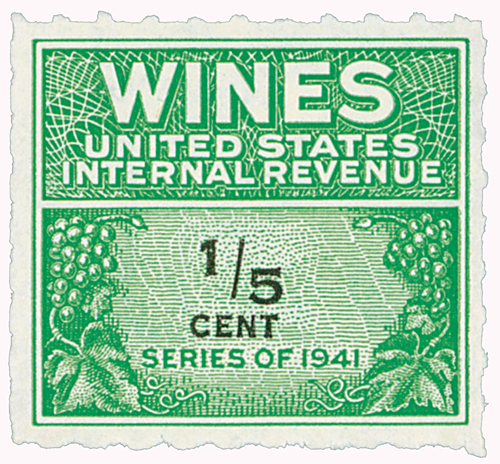

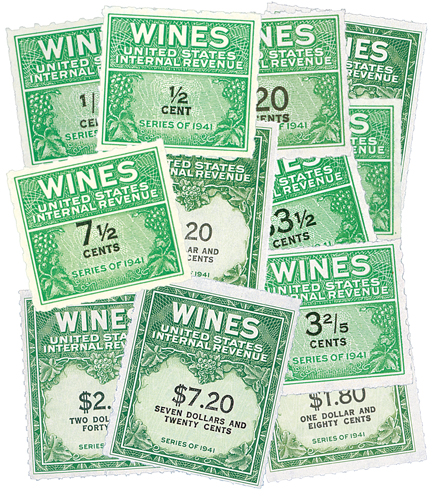

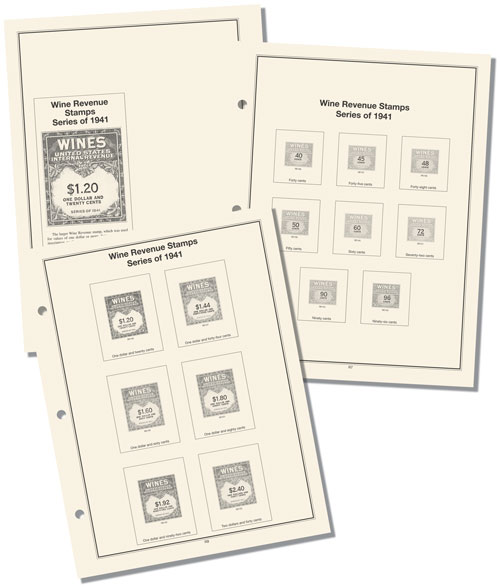

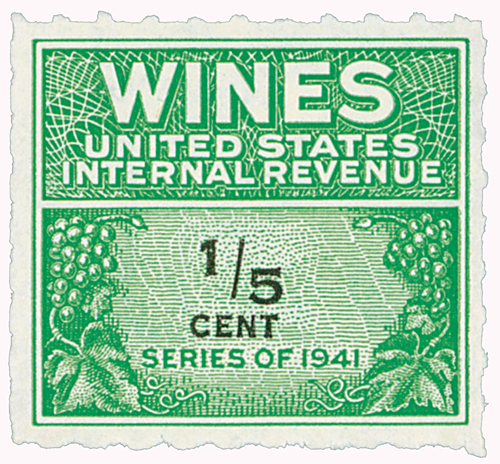

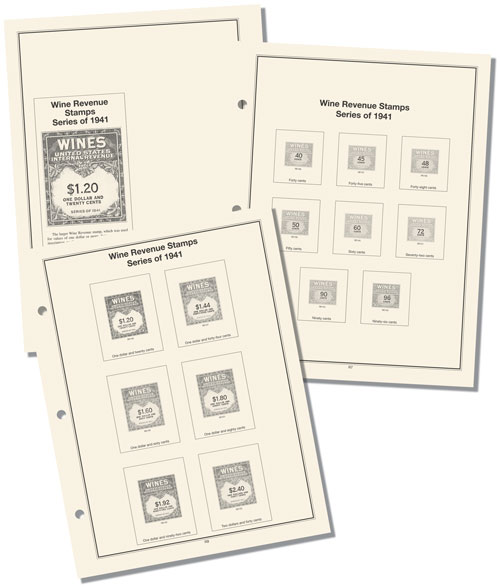

The Revenue Act of 1941 imposed a tax on wine effective October 1, 1941. The tax was intended to raise funds for the federal coffers to offset the cost of the impending war. The act established a complicated tax structure based on volume and percentage of alcohol. As a result of the various rates, the Series of 1941 Wine stamps is the largest revenue stamp series in US history with over 100 different denominations. The Series of 1941 Wine Revenue stamps also represents the first government use of standard backgrounds upon which values were overprinted.Â

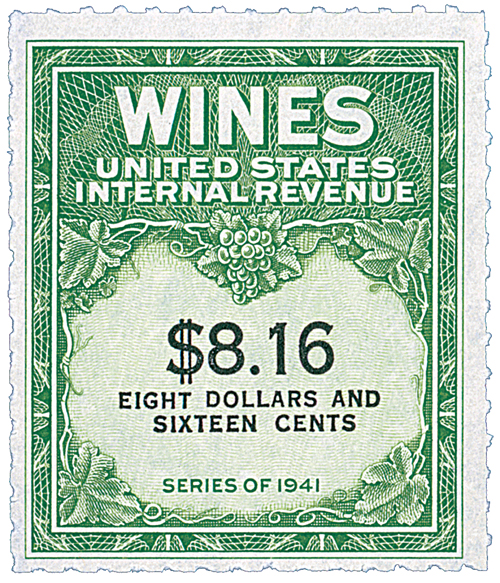

The 1941 Revenue Act established a complicated tax rate. Four different rates were set for four different types of wine. As a result, 16 different tax rates applied. The use of fractional-content bottles such as four-fifths quart and two-fifths gallon produced many unusual rates. In response, many Wine Revenue stamps feature odd values and fractional denominations.

The wine revenue tax rate was based on the type of wine and the alcohol content. Effective October 1, 1941, still wine with less than 14 percent alcohol by volume was taxed eight cents per gallon. Still wine with an alcohol content between 14 and 21 percent was subject to a tax of 30 cents per gallon. Sparkling wine was taxed at the rate of seven cents per half-pint unit. Artificially carbonated wine was subject to a tax of three and one-half cents per half-pint. The wine revenue tax was increased in 1942, 1944, and 1951. During the final period, the tax rate ranged from 12¢ per half-pint unit for artificially carbonated wine to 67¢ per gallon for still wine with a high alcohol content by volume.Â

The Series of 1941 Wine Revenue stamps were discontinued in 1954. Prior to 1949, it was illegal for collectors to possess the stamps, which were difficult to find in satisfactory condition. Most Wine Revenue stamps were issued without fanfare. Manufacturers were required to affix the stamps directly to bottles, cases, and tankers that were subject to rough handling and extreme weather conditions. Stamps were frequently covered with shellac or similar substances. Upon receipt, the stamp was further obliterated by pen or marker, which purposely damaged them to prevent reuse. As a result, several denominations are virtually unheard of in mint condition.

Click here for lots more Wine and Cordials stamps.

Â

Â

Wine Stamps

On October 22, 1914, the Emergency Revenue Act was passed, which called for the creation of Wine Revenue Stamps.

The US began using revenue stamps on a wide variety of items in the 1860s to help finance the Civil War. Labeled as “sin taxes,†the first alcohol stamps were issued for beer, not wine.Â

The outbreak of World War I in 1914 directly impacted America, significantly decreasing the customs from goods imported from Europe. To make up for this, the government passed the Emergency Revenue Act of October 22, 1914. This act increased the federal excise tax on wine and created a need for new Revenue stamps that were issued later that year.Â

All Wine Revenue stamps were printed on watermarked paper in shades of green. The Series of 1914 stamps included seven major design types with many denominations. Over the course of their use, wine stamps were issued in two sizes. Small stamps fit on single bottles, and had values from 1/5¢ through 96¢. Large stamps had values from $1.00 through $4,000.00. The higher values were used mostly on bulk wines being shipped in tanker trucks or ships. These stamps all feature intricate engraving and later issues pictured grapevines and clusters. Because they were affixed to containers, used Wine Revenue stamps are hard to find. Plus it was illegal to own mint stamps for several years, making them scarcer now.

In 1916, a new series of large-format Wine stamps were issued. They were in use from 1916 to 1933 and all featured a “SERIES OF 1916†inscription. All denominations from 1¢ to $2 were offset printed. The $4 through $9.60 stamps were engraved and had small changes made to the outer frame design.Â

The high-denomination Wine stamps ($20 through $100) of the Series of 1916 were issued from 1916 to 1934 and were inscribed “ACT OF SEPT. 8, 1916.â€Â These stamps feature an additional piece of paper to the right (called a tablet) for attaching additional Wine stamps. These new issues were perforated 12 or 12 1â„2 on the left only. The rest of the sides were imperforate.Â

From 1934 to 1940, lower-denomination Wine stamps were issued in smaller sizes once again. In addition to new smaller Wine stamps, there were also new large-format stamps. These were the 40¢ through $5 denominations.Â

The Revenue Act of 1941 imposed a tax on wine effective October 1, 1941. The tax was intended to raise funds for the federal coffers to offset the cost of the impending war. The act established a complicated tax structure based on volume and percentage of alcohol. As a result of the various rates, the Series of 1941 Wine stamps is the largest revenue stamp series in US history with over 100 different denominations. The Series of 1941 Wine Revenue stamps also represents the first government use of standard backgrounds upon which values were overprinted.Â

The 1941 Revenue Act established a complicated tax rate. Four different rates were set for four different types of wine. As a result, 16 different tax rates applied. The use of fractional-content bottles such as four-fifths quart and two-fifths gallon produced many unusual rates. In response, many Wine Revenue stamps feature odd values and fractional denominations.

The wine revenue tax rate was based on the type of wine and the alcohol content. Effective October 1, 1941, still wine with less than 14 percent alcohol by volume was taxed eight cents per gallon. Still wine with an alcohol content between 14 and 21 percent was subject to a tax of 30 cents per gallon. Sparkling wine was taxed at the rate of seven cents per half-pint unit. Artificially carbonated wine was subject to a tax of three and one-half cents per half-pint. The wine revenue tax was increased in 1942, 1944, and 1951. During the final period, the tax rate ranged from 12¢ per half-pint unit for artificially carbonated wine to 67¢ per gallon for still wine with a high alcohol content by volume.Â

The Series of 1941 Wine Revenue stamps were discontinued in 1954. Prior to 1949, it was illegal for collectors to possess the stamps, which were difficult to find in satisfactory condition. Most Wine Revenue stamps were issued without fanfare. Manufacturers were required to affix the stamps directly to bottles, cases, and tankers that were subject to rough handling and extreme weather conditions. Stamps were frequently covered with shellac or similar substances. Upon receipt, the stamp was further obliterated by pen or marker, which purposely damaged them to prevent reuse. As a result, several denominations are virtually unheard of in mint condition.

Click here for lots more Wine and Cordials stamps.

Â